FORECASTING THE FUTURE

Financial reporting is tedious, relying on a mess of disconnected spreadsheets and reports. As a finance expert, it’s your job to help steer the business. But if your reporting is a month behind, so are you.

DISCONNECTED DATA

PROJECT CONFIDENCE

Domo puts you in control of your data. Get back to leading your business with every meaningful metric in the palm of your hand. Domo connects to all your data so you can see exactly what’s going right and receive notifications when it’s not. Want to automate financial reports? Easy. Need to glean actionable insights across data silos? Done. Bring more to the boardroom with Domo.

- Consolidate reporting into a single channel

- Gain efficiencies of scale

- Improve access to data

- Maximize ROI

ANY BUSINESS. ANY ROLE.

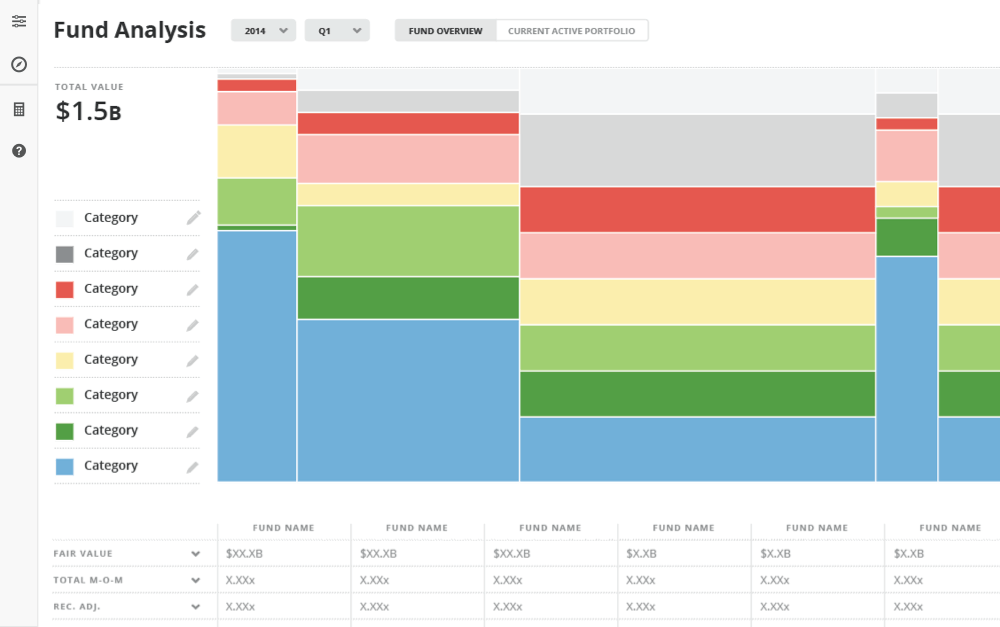

Banking

Domo brings together your most important metrics from multiple business lines, allowing you to adapt to an ever-changing industry.

- See deposits (DDM/savings) over time

- Set notifications for new account activity

- Manage credit risk portfolios

- Track treasury and non-interest fee income

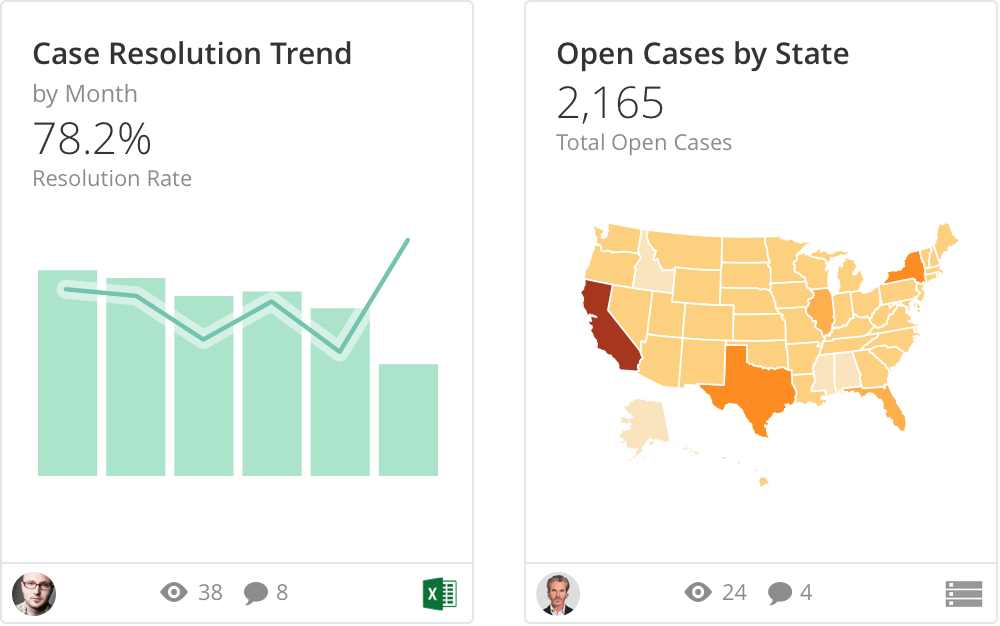

Insurance

In order to deliver the best possible product and solutions you need reliable, real-time data that doesn’t let you down. Domo saves you time, so you can save customers money.

- Calculate average cost per claim

- Follow claims ratios

- Track average claim settlement time

- See float, premium and loss activity

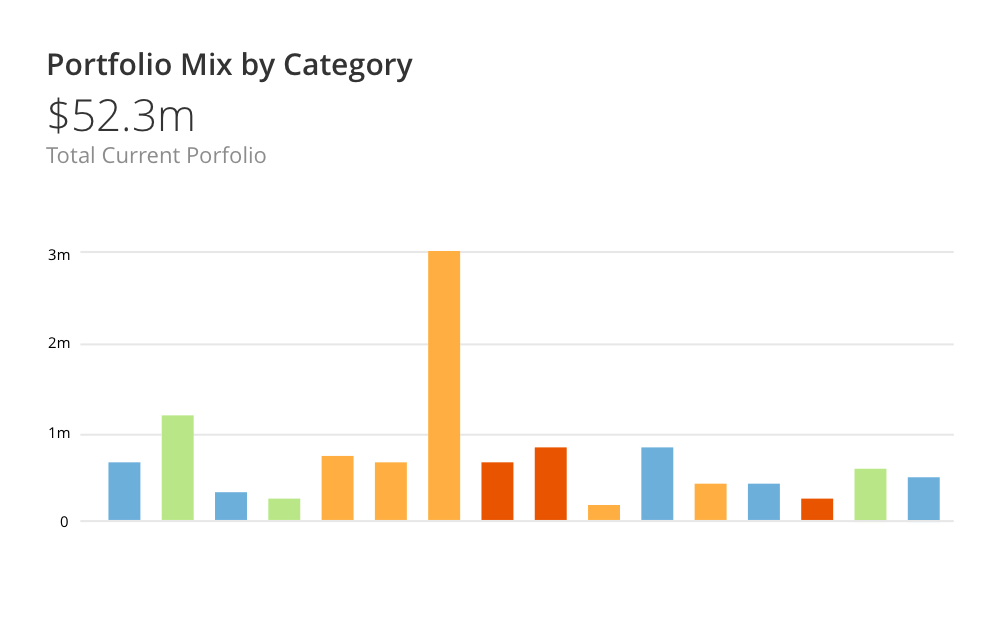

Securities & Investments

Domo lets you build your own dashboard, track the key financial indicators affecting your business and driving your bottom line. With Domo you can:

- Compare and measure IRR and indexing

- Track time-weighted returns

- Compare volatility

- Visualize correlation

- See maximum draw down